Transparency International – Corruption Perceptions Index 2025 and Implications for Companies Operating in Türkiye

The CPI 2025 highlights continued global governance decline, with Türkiye ranking 124th out of 182 countries and recording its lowest score to date. This environment increases regulatory, reputational, and compliance risks for companies. Businesses operating in Türkiye must strengthen internal controls, third-party due diligence, and governance frameworks to meet rising international enforcement and investor expectations.

11.02.2026

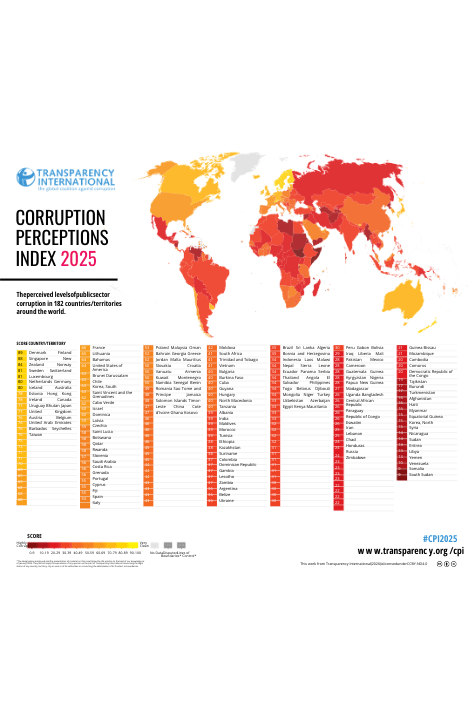

Transparency International’s (“TI”) Corruption Perceptions Index (“CPI”), which is published annually, assesses perceived public-sector corruption in 182 countries and territories based on data from 13 independent sources. The latest 2025 edition, recently published by TI, indicates a continued global decline in governance standards, with the global average score falling to 42 and 122 countries scoring below 50. Also, since 2012, 31 countries improved, 50 countries declined and 100 countries stayed the same.

Global Overview

The CPI ranks Denmark (89) first for the eighth consecutive year, followed by Finland (88) and Singapore (84). At the other end of the spectrum, Somalia (9), Venezuela (10), Yemen (13), and South Sudan (9) feature among the lowest-ranked countries in this year’s index. A limited set of 15 countries—primarily in Western Europe and the Asia-Pacific region—score above 75, and only five of them achieve scores exceeding 80, mainly in Western Europe and Asia-Pacific. The report also highlights deteriorating performance in several established democracies, demonstrating that corruption risks remain present even in traditionally strong institutional environments.

The report also notes a concerning decline among several democracies, with perceived corruption worsening in countries such as the United States (64), Canada (75) and New Zealand (81), as well as in parts of Europe including the United Kingdom (70), France (66) and Sweden (80). TI attributes this decline largely to weakened political leadership, democratic backsliding, and increasing restrictions on civic space. Countries that limit media freedom, civil society activity, and independent oversight are more likely to experience rising corruption risks. The report further emphasises that most journalists killed while investigating corruption operate in low-scoring countries, underlining the link between transparency and accountability.

Türkiye’s Position

Türkiye scored 31 in the 2025 CPI and ranks 124th out of 182 countries, placing it among the lowest-performing jurisdictions globally. This represents the lowest score in its CPI history and reflects a sustained downward trend over the past decade. Significantly, Türkiye's CPI score has seen a decline of 3 points since 2024, falling below the regional average of 34 for Eastern Europe and Central Asia and significantly lower than the global average.

The report associates declining scores with weakened institutional safeguards, politicisation of justice systems, reduced effectiveness of oversight bodies, and constraints on civic space. In Türkiye, increasing perceptions of corruption may affect regulatory predictability, public procurement processes, and confidence in administrative and judicial remedies. From a governance perspective, low CPI performance also signals risks to long-term economic stability, public trust, and the quality of public services. These factors may influence investment decisions and increase compliance-related scrutiny in cross-border transactions involving Türkiye.

Implications for Corporate Compliance Programs in Türkiye

Türkiye’s record-low CPI score carries significant implications for companies operating domestically or engaging in cross-border transactions involving Türkiye. While the CPI reflects perceptions of public-sector corruption rather than proven misconduct, lower scores typically translate into heightened compliance expectations from regulators, financial institutions, and international business partners.

1. Increased Third-Party Risk Exposure

Companies operating in lower-scoring jurisdictions face elevated risks in public procurement, licensing processes, customs interactions, and regulatory approvals. As a result, third-party intermediaries (agents, consultants, distributors) present heightened corruption exposure. Robust third-party due diligence, contractual safeguards, and ongoing monitoring become critical.

2. Enhanced Scrutiny Under Extraterritorial Anti-Corruption Laws

Multinational companies and Turkish entities with foreign shareholders may face increased exposure under laws such as:

- The U.S. Foreign Corrupt Practices Act (FCPA)

- The UK Bribery Act

- EU anti-money laundering and anti-corruption frameworks

Operating in a low-CPI environment may elevate enforcement agencies’ risk assessments and increase expectations for demonstrable “adequate procedures.”

3. Strengthened Internal Controls and Documentation

Where regulatory predictability is perceived as weaker, companies must compensate through stronger internal controls, including:

- Clear approval hierarchies for public-facing transactions

- Transparent documentation of interactions with public officials

- Segregation of duties and financial oversight

- Effective whistleblowing mechanisms

Documentation quality becomes particularly important in the event of cross-border investigations.

4. Board-Level Oversight and Tone at the Top

Increased corruption perception heightens the importance of governance culture. Boards of directors should:

- Receive periodic corruption risk assessments

- Oversee compliance KPIs

- Ensure independence of compliance functions

- Allocate sufficient compliance resources

Failure to implement credible oversight may expose directors to personal liability in certain jurisdictions.

5. Reputational and Investment Risk

International investors, ESG-focused funds, and financial institutions increasingly incorporate CPI metrics into country risk assessments. Lower scores may influence:

- Financing conditions

- Insurance premiums

- M&A due diligence intensity

- Valuation assumptions

Proactive compliance frameworks may therefore serve as a competitive differentiator.

Conclusion

The CPI 2025 confirms that corruption remains a major global governance challenge, driven by weakened leadership, democratic regression, and shrinking civic space. Türkiye’s record-low score highlights the urgent need for stronger institutional safeguards, enhanced transparency, and credible enforcement mechanisms.

For companies operating in Türkiye, CPI 2025 should be interpreted not only as a governance indicator but as a compliance signal. In lower-scoring environments, regulators, investors, and global counterparties expect stronger internal safeguards, enhanced transparency, and demonstrable commitment to ethical conduct.

You can read the full report here.

-

Kemal Altuğ Özgün

Managing Partner

-

Emire Özeyranlı

Associate

-

Onur Akar

Legal Trainee