An Overview of Occupational Fraud 2024: A Report to the Nations by ACFE

The Association of Certified Fraud Examiners ("ACFE"), a global anti-fraud organization, has recently published its 2024 Occupational Fraud Report (the "Report"). Drawing from data spanning 138 countries and 22 industry sectors, the report reveals staggering losses exceeding USD 31.1 billion due to occupational fraud.

22.03.2024

Key Findings

The ACFE Report classifies fraud into three main categories: asset misappropriation, corruption, and financial statement fraud. Asset misappropriation is identified as the most common, whereas financial statement fraud is the costliest. The duration before fraud detection stands at an average of 12 months, which accentuates the stealth and complexity of these schemes. It is estimated that organizations lose 5% of their yearly revenues to this global issue each year and corruption is observed in 48% of all cases, marking its substantial impact in the corporate world.

Industry Specific Insights and Operational Vulnerabilities

The Report highlights a shift in median losses, with the mining sector currently experiencing the greatest financial impact, a notable change from real estate in the 2022 Report. The analysis also establishes departments most susceptible to fraud within an organization, noting operations, accounting, and sales departments as the leading sources of cases. The disparity in median losses between different levels of perpetrators remains similar to previous years with frauds committed by owners or executives averaging USD 459,000, starkly exceeding those by lower-level employees by over seven times.

Red Flags

The Report urges organizations to take proactive measures and notes that 84% of fraudsters showed behavioral red flags, which should be recognized to enhance early detection of fraud. The most common red flags were living beyond means (39%), financial difficulties (27%), and close associations with vendors or customers (20%). Additionally, 45% of perpetrators faced job-related stressors, such as poor performance evaluations and fear of job loss, which might motivate fraudulent practices.

Tips as the Most Effective Method in Fraud Detection

Tips are found to be the leading fraud detection method, as it was in the previous two reports, accounting for 43% of cases and outperforming other methods like internal audits and management reviews by threefold. This finding emphasizes the value of speak-up programs and whistleblowing practices in the detection of occupational fraud, given that the majority of these tips came from employees. The Report indicates a continued shift from traditional phone hotlines to email and web-based reporting since 2018, with text messaging now accounting for 3% of tips, signifying evolving whistleblowing channels. Additionally, it highlights the significant role of informal reporting to supervisors, making up 29% of non-hotline tips, and underscores the necessity of fraud allegation management training to support an open organizational culture and enhance early fraud detection.

Corporate Reputation and Fear of Bad Publicity

It is important to note that the consequences of fraud extend beyond financial losses with the potential to impact an organization's reputation. The data demonstrates that a significant proportion of companies remain hesitant to refer cases to law enforcement, and 34% of companies cite fear of bad publicity as their primary concern. This apprehension highlights the delicate balance between maintaining corporate reputation and ensuring accountability.

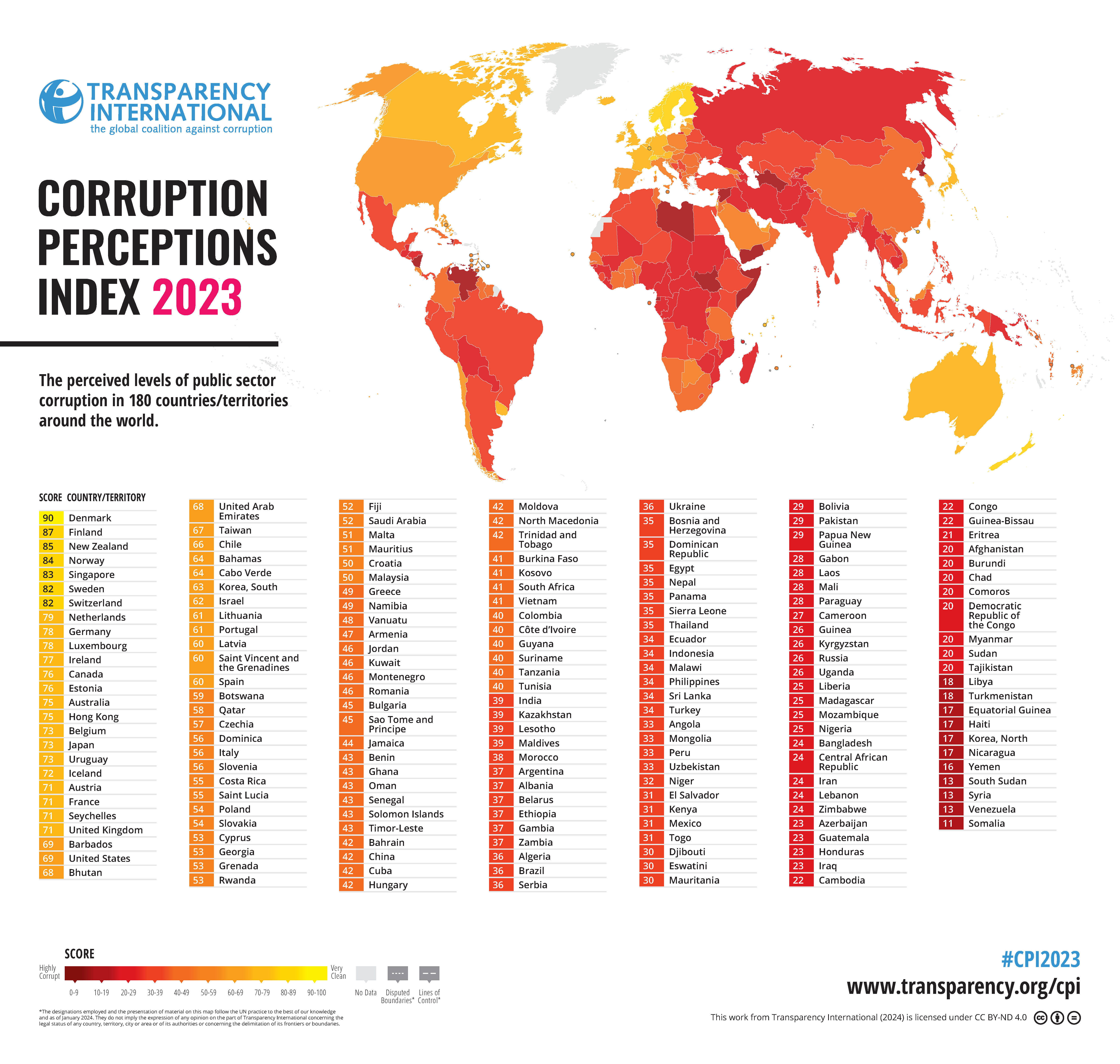

Findings in Relation to Turkey

Accordingly, Türkiye emerges prominently in the Eastern European and Western Central Asia region, recording nine cases and marking the highest number in this geographic area. This development is marking a shift given that Türkiye did not feature as the leading country in the 2022 and 2020 reports within the region. This finding coincides with Türkiye's notable decline in the global Corruption Perceptions Index (“CPI”) rankings last year, plummeting fourteen places. This decline is part of a longer-term trend, with Türkiye's CPI score decreasing by 11 points since 2014, now falling below the regional average of 35 for Eastern Europe and Central Asia. The correlation suggests a significant rise in perceived corruption levels, highlighting the urgent need for greater transparency and strengthened anti-fraud and anti-corruption measures in the country.

Practical Considerations

A significant finding from the study is that the most prevalent contributors to fraud were the lack of internal controls (32%) and the override of existing internal controls (19%), collectively accounting for over half of all cases. This emphasizes the necessity for businesses, particularly in regions like Türkiye, to prioritize the development and enforcement of comprehensive compliance programs. Companies can mitigate risks and distinguish themselves by committing to ethical practices and strict adherence to international regulations such as the FCPA, UK Bribery Act, and Sapin II. Integrating these standards through a robust compliance program not only safeguards against revenue losses but also enhances credibility with potential partners and investors, proving essential in navigating the complexities of the global market despite the presence of local legal shortcomings.

The key elements of a comprehensive compliance program should include anti-fraud training for employees, a robust reporting mechanism, and regular fraud risk assessments to identify vulnerabilities. Critical anti-fraud controls must also be implemented, such as proper separation of duties, clear authorization processes, physical safeguards, job rotations, and mandatory vacations. Together, these measures form a solid framework for detecting and preventing fraud within an organization, thereby averting financial consequences.

Conclusion

The ACFE Report provides crucial insights into the global issue of occupational fraud, emphasizing the necessity for strong internal controls, compliance programs, and employee engagement in fraud detection while highlighting fraud’s significant financial impact on organizations worldwide, particularly in high-risk regions such as Türkiye. Implementing the recommended practices not only aids in fraud prevention and minimizing financial loss but also reinforces a culture of integrity and transparency, essential for long-term organizational health and investor confidence.

The ACFE Report underscores the critical importance of proactive anti-fraud strategies, emphasizing the necessity for strong internal controls, compliance programs, and employee engagement in fraud detection efforts. Implementing these measures not only mitigates financial losses but also fosters a culture of integrity and transparency crucial for long-term organizational sustainability.

For access to the ACFE Report, please refer here.

-

Kemal Altuğ Özgün

Managing Partner

-

Oya Tekelioğlu

Trainee